Who are the top seeded players of the investment world?

- Bestinvest has analysed over 570 fund manager career track records across their various employers and funds within respective sectors to rank the equity managers with the greatest success in beating the markets and for consistency of outperformance

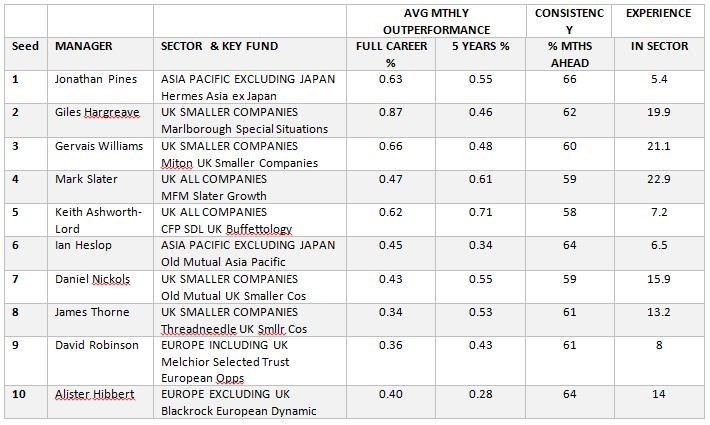

- Asia Pacific ex Japan manager Jonathan Pines takes the top seed, closely followed by a trio of UK equity managers, Giles Hargreave, Gervais Williams, Mark Slater respectively

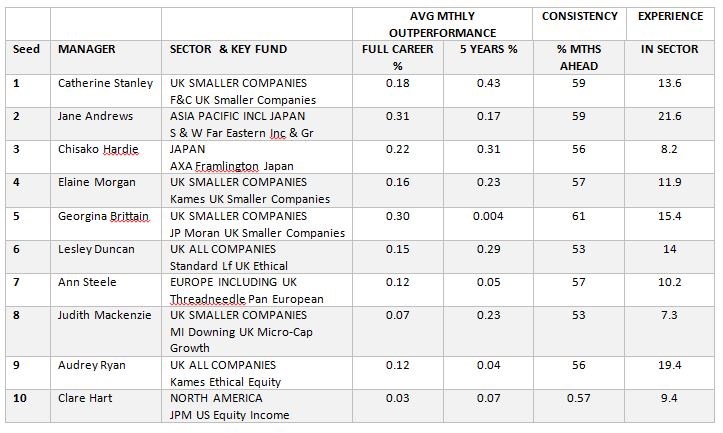

- In the women’s tournament UK Smaller Companies manager Catherine Stanley is the top seed, while Smith & Williamson’s Jane Andrews is in the second spot for managing Asia Pacific including Japanese assets

It feels like we have been in the depths of Summer for a number of weeks as the weather seems to have simply bypassed Spring going from the Beast from the East to the hottest May on record. However, any Brit knows that the real drum of the essence of Summer is Wimbledon, when a fortnight of world class tennis is eased along with Pimms' and strawberries swimming in cream. This year Wimbledon begins on Monday 2 July when the greatest tennis players in the world will descend on the All England Lawn Tennis Club, London. The players are ranked ahead of the tournament, a process known as “seeding”, with the aim that the top seeded players meet later on in the tournament.

In the same spirit, online investment platform Bestinvest has used its own proprietary database of fund manager career performance data to identify which managers currently hold the top seeded positions in the men’s and women’s singles, and doubles categories. The research looked at 573 identifiable equity fund manager career track records with a minimum period of five years and across a wide range of sectors to rank those with the strongest career track records for both generating market benchmark beating returns and consistency.

In compiling the research, Bestinvest looked at track records of each manager within their respective sectors across multiple employers they may have worked for over their careers. Where managers have run more than one fund in the same sector at the same time, a blended track record was used. Managers were then scored on a number of factors: these included the average monthly excess performance over and above their market benchmark both over their full career history in a sector and also over the last five years. This twin performance filter was applied to recognise managers who have both performed well across their entire career and who have continued to do so in more recent times, as some fund managers can start out well but performance deteriorates as assets grow, they take on other responsibilities or burn out and lose their hunger for success.

Consistency is also an important attribute as it helps to distinguish between managers whose long term records may have been favourably distorted by a ‘lucky’ streak and those with genuine skill. Managers were therefore also ranked on the percentage of individual months that they have delivered performance ahead of their benchmark during their career. A final ranking was applied based on the length of a manager’s track record as the more data, the more reliable the insights. An overall ranking was applied based on each of these, with a half weighting given to career duration.

Jason Hollands, Managing Director of Bestinvest, said: “The current top men’s seed is Jonathan Pines, who manages the Hermes Asia ex Japan Equity fund. Pines’ is a relative newcomer with a track record of just five and a half years, so it is impressive to have achieved such a score when our ranking system specifically rewards managers with longer track records. But the extent of his outperformance so far has been significant and he has also beaten the market across 66% of the months he has been running money. Pines’ fund has done well on the back of hefty exposure to China, so only time will tell whether this stellar run of performance proves durable.

“The next three top men’s seeds can firmly be classified as veteran investors, having accumulated over 60 years’ experience between them. In second place is UK smaller companies guru Giles Hargreave who has been managing his flagship Marlborough Special Situations fund since 1998. Another UK small-cap manager, Gervais Williams, is seeded in third place, now running the Miton UK Smaller Companies fund alongside his role as Chief Executive of AIM-listed Miton Group PLC.”

“Amongst the women fund managers, Catherine Stanley of BMO Global Asset Management holds the top seed for her record as an investor specialising in UK smaller companies funds – though she also manages two ethical funds as well. Jane Andrews, manager of the Smith & Williamson Far Eastern fund, is the second top seed female fund manager. Remaining on that side of the world our third seeded female fund manager, Chisako Hardie, heads up the Axa Framlington Japan fund which invests across the market-cap spectrum and has a particularly high weighting to medium sized companies.

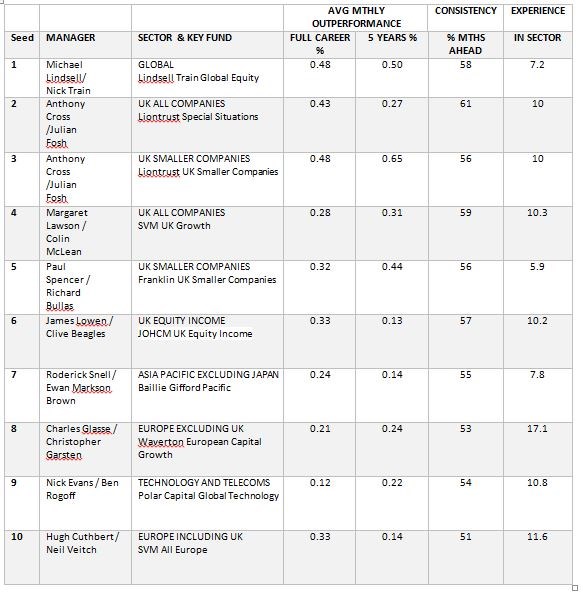

“Some funds are managed by co-managers rather than solo players, so we have also ranked the top double acts. Holding the top spot for doubles is Lindsell train duo, Michael Lindsell and Nick Train, based on their global equities performance. The Lindsell Train Global Equity fund invests in a concentrated portfolio of cash-generative business franchises which are held for the long term. The biggest holdings in the fund are well-known household names like of Diageo, Heineken, Nintendo and PayPal, which although they note are often deemed to be ‘boring’, over the long term ‘boring’ wins out. Liontrust duo Anthony Cross and Julian Fosh, follow up in both second and third seed for their record running UK equities funds, with their flagship Liontrust Special Situations fund in second place and their UK Smaller Companies in third. Cross and Fosh have a distinctive investment process which they call the Economic Advantage approach which targets companies able to grow throughout the cycle by having hard to replicate characteristics such as ownership of intellectual property, recurring revenue streams or strong distribution channels. In fourth place are Margaret Lawson and Colin McLean, who co-manage the SVM UK Growth fund. The latter invests in three categories of stocks: core, long-term holdings, tactical plays based on current market conditions, such as cyclical companies, and so-called ‘alpha kickers’ which are special situations such as businesses undergoing turnarounds.”

“It is really noticeable how many of the fund managers who have added the most value are either smaller companies specialists or typically weight more heavily to small and medium sized companies compared to broader benchmarks. These are parts of the market which are under-researched by investment banks and therefore where an active approach to spotting hidden gems has the potential to reap hefty rewards.”

Mens Singles

Ladies Singles

Doubles

ENDS

Important Information:

The value of investments, and the income derived from them, can go down as well as up and you can get back less than you originally invested. This article does not constitute personal advice. If you are in doubt as to the suitability of an investment please contact one of our advisers. Past performance is not a guide to future performance. This article is based on our opinions which may change without notice.

Smaller companies shares can be more volatile and less liquid than larger company shares, so smaller companies funds can carry more risk. Underlying investments in emerging markets are generally less well regulated than the UK. There is an increased chance of political and economic instability with less reliable custody, dealing and settlement arrangements. The market(s) can be less liquid. If a fund investing in markets is affected by currency exchange rates, the investment could both increase or decrease. These investments therefore carry more risk. Funds may carry different levels of risk depending on the industry sector(s) in which they invest. You should ensure that you understand the nature of any fund before you invest in it. You should make yourself aware of these specific risks prior to investing.

Disclaimer

This release was previously published on Tilney Smith & Williamson prior to the launch of Evelyn Partners.