Why arent prices at the pump fully reflecting the slide in Crude Oil prices

Andrew Ramsbottom, Director, Research at Tilney Bestinvest discusses how the taxation of petrol in the UK means that the prices at the petrol pumps don’t reflect the scale of the decline in Crude Oil prices.

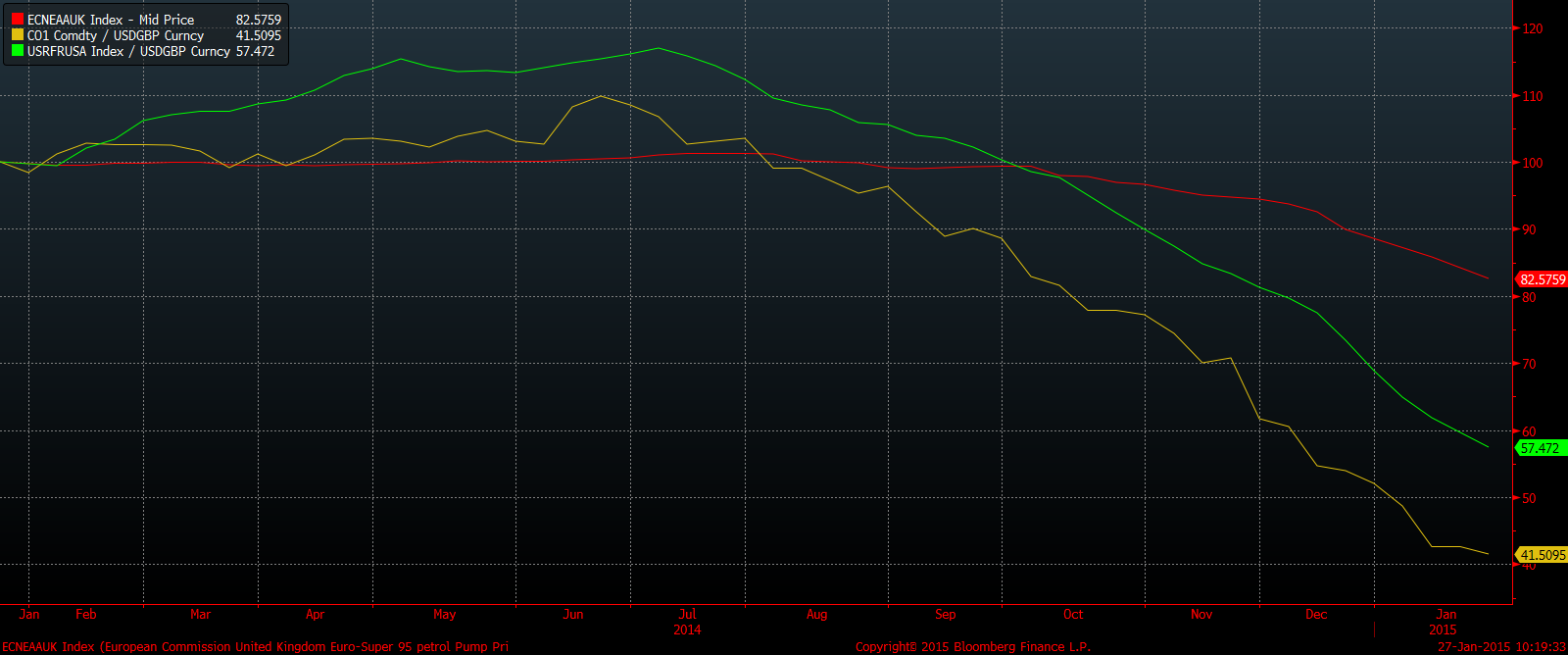

One of the major global macro-economic themes since June last year has been the dramatic slide in oil prices. This is a result of oversupply in the wholesale crude market and the decision by Saudi Arabia to continue pumping at its previous levels (in order to try and defend its market share). This has more than halved the price of Brent Crude, as you can see in the chart below (yellow line).

Most economists regard the cost of fuel as operating like a tax. This is because:

- It’s a significant share of most household budgets; some 4 ½% of typical family spending in the UK.

- Demand is fairly unresponsive to the price, reflecting the importance of motoring to our lifestyle.

Hence, the higher the price of fuel, the more that is spent on it to cover the same mileage and so the less disposable income there is left to buy other things. It should, therefore work the other way around.

Falling oil prices have been welcomed by politicians and economists alike. The resultant fall in the petrol price should leave motorists with extra money in their pockets. Most if not all of this windfall is likely to be spent, particularly since most earners are estimated to have suffered around a 10% cut in their real income since the events of 2008, given that pay rises have been scarce and inflation has continued to erode the purchasing power of their income. This should therefore feed directly into higher spending, thus reinforcing the recovery in the economy.

Brent Has Halved, but UK Pump Prices Have Fallen by Less Than 20%. Why?

The chart below looks at UK (red) and US (green) pump prices and the price of a barrel of Brent Crude, its raw material. The axis has been rebased so the two can be compared and the figures are all in sterling. As you can see, over the first half of 2014, when the crude oil price was high and stable, pump prices were fairly static. However, since the end of last June, Brent has roughly halved, whilst the pump price is down by less than 20% in the UK. The windfall hasn’t been as large as one might expect.

Brent Crude in Sterling (yellow), UK Pump Prices (red) and US Pump Prices in Sterling (green) all over the Last Year (rebased)

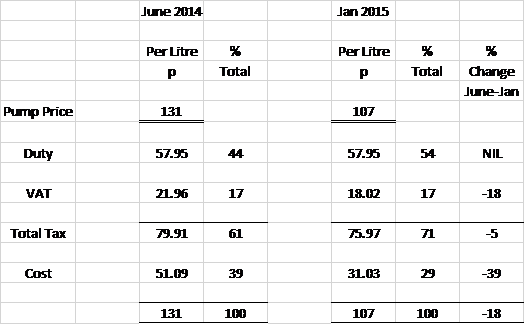

Where has the difference gone? Have we been short changed by the oil companies? To answer these questions we need to look at the key components of the UK petrol price, and how these have changed from June, before the price of crude started to fall, to now, when it has halved:-

The Pump Price of a Litre of Petrol in the UK: June 2014 and Now

Hence, whilst the overall price has fallen 18%, and the underlying cost (including the petrol station’s margin) has fallen by 39%, the government’s tax take has been reduced by only 5% (see right-hand column).

Fuel tax is made up of two specific elements: a specific duty (which was set in the last budget at 57.95p) and VAT at the standard 20%. Because of the way it is levied, we pay VAT not only on the cost of fuel, but also on the duty paid. – a tax on a tax!

Because the duty (and therefore over half the VAT) is fixed per litre, it does not change with the price. Hence, as the price of fuel has fallen by 18% (from 131p to 107p) the government’s tax take has only fallen from 79.91p to 75.97p (ie 5%).

UK Fuel is Amongst the Most Expensive in Europe

According to the RAC Foundation, at 107p/l, petrol in the UK is the third most expensive in Europe, notably higher than comparable countries such as Germany and France (96p/l and 90p/l respectively). This is despite the fact that the underlying cost of petrol in the UK is amongst the lowest in Europe; the tax paid per litre is, however, one of the highest.

US Pump Prices Have Halved, Due to lower Duty

Looking at the green line, we can see that US pump prices have roughly halved over the same period, so that a litre currently costs only 41p. Of this, only 8 ½ p is typically duty; just over 20% of the pump price compared to 71% in the UK. The underlying cost is similar to the UK; 32.5p v 31.03p. Because the cost in the US is a much larger percentage of the total pump price, proportionally more of the fall in the oil price is passed on to the consumer in the form of a lower pump price, rather than continuing to be swallowed up by duty.

- ENDS –

Press contacts:

Roisin Hynes

0207 189 2403

07966 843 699

roisin.hynes@tilneybestinvest.co.uk

Matthew Gray

0207 189 2492

matthew.gray@tilneybestinvest.co.uk

Important information

The value of investments, and the income derived from them, can go down as well as up and you can get back less than you originally invested.

We aim to provide investors with information to help them make their own investment decisions although this should not be construed as advice or an investment recommendation. If you are unsure about the suitability of an investment or if you need advice on your specific requirements, we strongly suggest that you consider professional financial advice.

About Tilney Bestinvest

Tilney Bestinvest is a leading investment and financial planning firm that builds on a heritage of more than 150 years. We look after more than £9 billion of assets on our clients’ behalf and pride ourselves on offering the very highest levels of professional client service with transparent, competitive pricing across our entire range of solutions.

We offer a range of services for clients whether they would like to have their investments managed by us, require the support of a highly qualified adviser, prefer to make their own investment decisions or want to take more than one approach. We also have a nationwide team of expert financial planners to help clients with all aspects of financial planning, including retirement planning.

We have won numerous awards including UK Wealth Manager of the Year, Low-cost SIPP Provider of the Year and Self-select ISA Provider of the Year 2013, as voted by readers of the Financial Times and Investors Chronicle. We are pleased that our greatest source of new business is personal referrals from existing clients.

Headquartered in Mayfair, London, Tilney Bestinvest employs almost 400 staff across our network of offices, giving us full UK coverage, and we combine our award-winning research and expertise to provide a personalised service to clients whatever their investment needs.

The Tilney Bestinvest Group of Companies comprises the firms Bestinvest (Brokers) Ltd (Reg. No. 2830297), Tilney Investment Management (Reg. No. 02010520), Bestinvest (Consultants) Ltd (Reg. No. 1550116) and HW Financial Services Ltd (Reg. No. 02030706) all of which are authorised and regulated by the Financial Conduct Authority. Registered office: 6 Chesterfield Gardens, Mayfair, W1J 5BQ.

For further information, please visit: www.tilneybestinvest.co.uk

Disclaimer

This release was previously published on Tilney Smith & Williamson prior to the launch of Evelyn Partners.